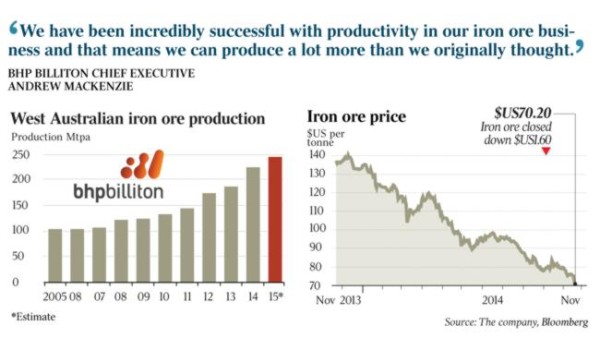

BHP Billiton, the world’s largest miner, is not concerned with the five-year-low iron ore price, saying its West Australian operations are still making a good margin, as it defends its expansion strategy in an oversupplied market.

Chief executive Andrew Mackenzie said, after the miner’s annual general meeting in Adelaide yesterday, that despite the price of the steelmaking commodity hovering just above $US70 a tonne, the miner’s iron ore division was still one of its most profitable businesses.

BHP and its main rival, Rio Tinto, recently came under fire from West Australian Premier Colin Barnett, who questioned their expansion strategies and ¬accused the world’s largest iron ore producers of “seemingly acting in concert” to keep the price at low levels.

Jac Nasser, chairman of the global miner, hit back yesterday, saying the capacity additions were not “secret” and added that the company’s iron ore expansion plans had been “long pipeline” -investments.

“They don’t creep up on you; they get approved by many people in the process including government regulators and government,” Mr Nasser said.

Mr Mackenzie added that the company had not had an approval of an iron ore expansion project by its board since 2011.

“Our company has been very clear that the time for massive expansions of iron ore is over and we have shifted our investment into the energy sector, predominantly copper and petroleum, and we started doing that three years ago,” he said.

“We have been incredibly successful with productivity in our iron ore business and that means we can produce a lot more than we originally thought we would be able to do, both from long–established assets and stuff we have subsequently invested in, and that is something we will continue with.”

Mr Mackenzie added that the miner was ready for the low prices and had been clear that today’s level was what it expected for the longer term, but he did say the rapid fall below $US100 a tonne nine months ago was unexpected.

The diversified miner used yesterday’s AGM, following its meeting in London last month, to update shareholders on the company’s planned $17 billion merger of its non-core assets.

BHP said it expected to release all shareholder documentation with full details of the demerger in March, with a shareholder vote scheduled for May.

Mr Nasser told investors that the company had made good progress in recent weeks and that the demerger was on track.

“We have received a number of the more significant regulatory approvals, including from Australia’s Foreign Investment Review Board and the Australian Taxation Office and we are progressing well on those that remain outstanding,” Mr Nasser said.

He said that, through the demerger, the company could reduce costs and improve the productivity of its remaining assets more quickly.

“This means we should generate stronger growth in free cash flow and a superior return on investment,” he said.

The market has widely debated a potential share buyback by the mining major, but Mr Mackenzie made it clear yesterday it was not a priority for the company.

He said there was a list of other items he and his team were focused on, such as ensuring the balance sheet remained strong so it could invest and pay the progressive dividend through the cycle.

Mr Mackenzie said the board “might” consider a buyback only after the list of other priorities was ticked off. He added that looking after the dividend was the No 1 imperative for the board and the management team.

“As things sit we feel the dividend at its current level is well covered,” he said, despite lower commodity prices in its key products.

BHP also updated shareholders on its Olympic Dam expansion plans; Mr Mackenzie highlighted yesterday that the heap-leach process it was trialling was showing “promise”.

The company shelved a “big-bang” $30bn expansion of the South Australian copper, gold and uranium mine two years ago and is assessing smaller expansions, it is hoping to use the more cost-effective heap-leach process at the site.

Mr Mackenzie said that if the heap-leaching trials proved successful, then the miner would use the technology and phased expansions of the underground mine to further increase Olympic Dam’s output.

South Australia had been banking on the original $30bn expansion plan to underpin an economic surge and any hint of success with the new low-cost option would be closely watched.

“We are about halfway through the testing period to know if it will work,” he said.

Source: The Australian